In a landmark decision, the Federal Tax Ombudsman (FTO) has ruled that power distribution companies must charge an 18% sales tax on the full electricity supply without accounting for net metering. This comes in response to concerns over substantial revenue losses for the government, which have amounted to an annual shortfall of Rs 9.38 billion due to incomplete tax collection by state-owned distribution companies (DISCOs).

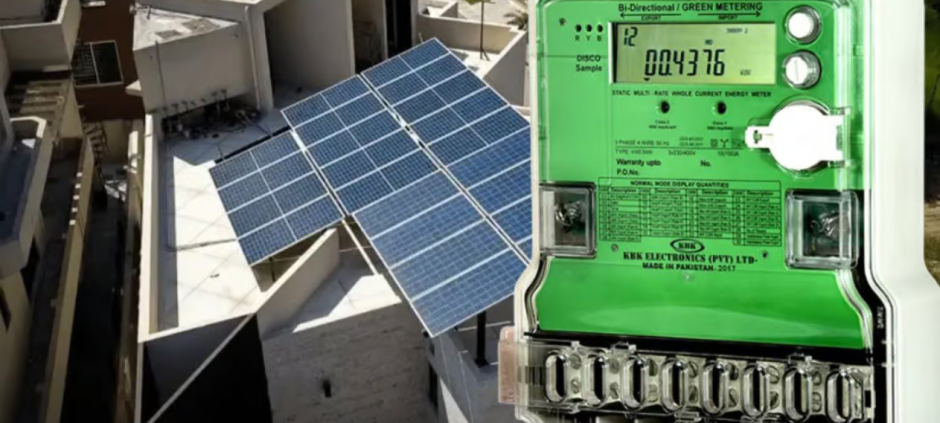

An investigation revealed that while K-Electric has been collecting sales tax on the gross electricity supplied, other DISCOs were only charging consumers based on net usage—deducting electricity fed back into the grid through solar net metering. This discrepancy has now been addressed, with the FTO stating that Pakistan’s tax laws do not recognize net metering for sales tax purposes.

Also Read: Electricity Prices Anticipated to Drop Soon

The ruling mandates that distribution companies calculate sales tax based on total energy supplied, irrespective of the electricity returned to the grid by consumers using solar panels. The FTO has recommended that the Federal Board of Revenue (FBR) launch a formal investigation into tax collection practices within the power sector, with findings expected within 60 days.

Millions of consumers with solar panels may now face higher electricity bills, as the tax calculation will shift from net consumption to total supply. This move is intended to prevent further revenue losses and bring uniformity to the taxation process across the country’s power distribution companies.

The FBR’s forthcoming investigation will seek to identify why some distribution companies failed to apply the correct tax and will recommend steps to ensure compliance across the board.