[vc_row][vc_column][vc_column_text dp_text_size=”size-4″]The Pakistani economy has been plagued by one crisis after another, which has severely reduced purchasing power and increased price sensitivity among people.

Meanwhile, the cost of running a business, particularly e-commerce stores, has increased significantly. This is despite the fact that the cost of commodities is already under pressure. Government-imposed import restrictions made matters worse.

Since the beginning of 2022, when there have been fast devaluations, unprecedented inflation rates, and default rumours, the crisis’ intensity has increased significantly.

The ongoing economic and political situation in Pakistan, including the 86.65 percent YoY decline in VC funding, has choked the key source of funds to subsidise customer acquisition and growth and put a serious strain on e-commerce companies as they struggle to maintain their current levels, let alone grow, according to Data Darbar’s “State of B2C E-commerce in Pakistan” report.

The percentage change from 2021 levels, according to the research, exhibits a definite downward trend up until September before making a minor rebound in O-N-D (October, November, and December). In comparison to 2021, traffic to seven out of the nine click-and-mortar stores examined for this analysis decreased in 2022.

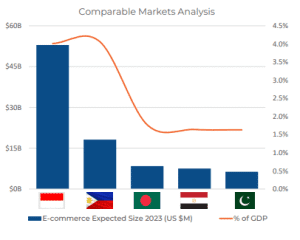

The cumulative annual growth rate (CAGR) is anticipated to be 6.2 percent over the following five years. Due to the currency’s ongoing decline and the lowered economic growth projections that resulted, the anticipated growth rate is “relatively muted”.

The country nevertheless “lags well behind” comparable economies like Indonesia, the Philippines, Egypt, and Bangladesh despite the fact that the size of the online B2C retail sector has increased over time, according to the report. Between the peer group, Pakistan’s market is the smallest in both absolute and relative terms.

The largest click-and-mortar retailer in Pakistan, according to the survey, is J., which has annual global sales of $71.8 million. J. is followed in size by Limelight ($50.3 million), Gul Ahmed ($48.3 million), Khaadi ($29.1 million), and Sapphire ($34.2 million).

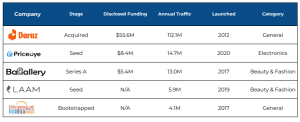

With 112.1 million visits annually, Daraz led the pack of top e-commerce sites in terms of traffic, followed by Priceoye (14.7 million), Bagallery (13 million), Laam (5.9 million), and iShopping.pk (4.1million)

.

The amount of money given to e-commerce firms has been on a “steep upward trajectory” from 2019, going from $2.3 million in 2019 to more than $190 million in 2022. Despite the fact that the majority of this money has recently been invested in the B2B segment, the sector’s portion of total investment value in the nation climbed tenfold.

In Pakistan, more than one-fifth of all investments were made in the e-commerce sector last year.[/vc_column_text][/vc_column][/vc_row]