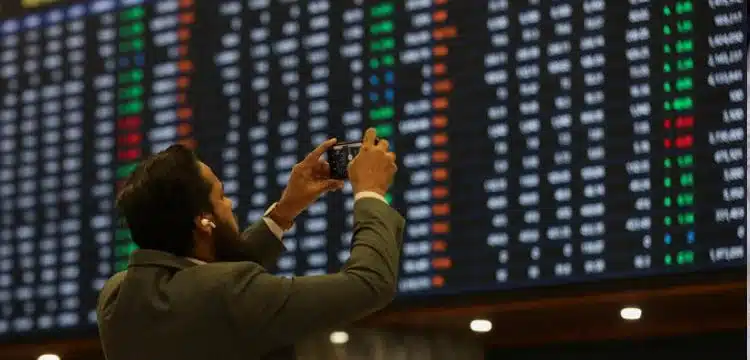

[vc_row][vc_column][vc_column_text dp_text_size=”size-4″]The Pakistan Stock Exchange experienced a state of panic during the post-election session, with investors reacting to uncertainty surrounding the election results. In the initial hours of Friday, the benchmark KSE-100 index witnessed a significant drop of 2,000 points, causing concern among market participants.

At the commencement of the trading session, the KSE benchmark index plummeted to 61,781.76, marking a substantial decrease of over 2,000 points. The unexpected general election results contributed to this sharp decline, leading to an atmosphere of uncertainty and caution among investors.

Read more: Latif Khosa Wins NA-122 In 2024 Elections

Analysts attribute the PSX downturn to the delayed announcement of election results, leaving investors in a state of unease as they await clarity on the political landscape. The fluctuation in PSX reflects the unexpected nature of unofficial election results, with the political future of the country, home to 240 million people, still uncertain.

During the post-election trading session, Index-heavy stocks, such as Oil & Gas Development Company (OGDC) and Pakistan Petroleum (PPL), were observed trading in the red. Investors, who had anticipated gains in the stock market, were met with a different reality, given the unexpected election outcomes.

The PSX’s previous closing at 64,143, which was 345 points higher a day before the polls, had created optimism among investors. However, the post-election scenario brought about a reversal of fortunes, highlighting the impact of the ongoing political developments on the stock market.

As preliminary and unofficial election results surfaced, it became evident that PTI-backed independent candidates were leading in key constituencies. Meanwhile, prominent political entities like PML-N and PPP were engaged in a competitive race for the majority, adding further complexity to the political landscape. The unfolding political dynamics continued to fuel uncertainty, influencing investor sentiment in the stock market.[/vc_column_text][/vc_column][/vc_row]