[vc_row][vc_column][vc_column_text dp_text_size=”size-4″]The President of Pakistan has directed that manual filers of income tax returns should now receive the same tax benefits as those filing electronically. Additionally, he cautioned the Federal Board of Revenue (FBR) that the Federal Tax Ombudsman (FTO) holds legal authority under the FTO Ordinance, 2000 to instruct the agency to address and rectify instances of maladministration.

Rejecting an appeal filed by the FBR against an FTO order, the President emphasized that statutory bodies are obligated to fulfill their duties in accordance with the law, warranting no interference with the FTO’s decision.

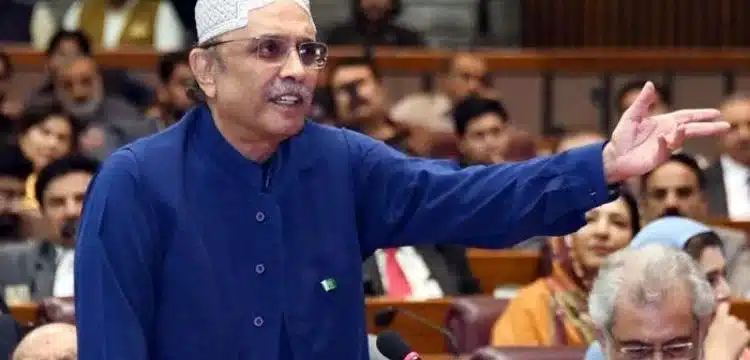

Read more: Zardari Declines Salary Amid Pakistans Economic Challenges

A Lahore-based tax lawyer, Waheed Shahzad Butt, raised this issue before the FBR and FTO, leading to consultations and resolution without resorting to unnecessary litigation.

FTO Dr. Asif Jah instructed the FBR to establish mechanisms and SOPs to ensure the active status of all manual filers in the latest tax year, as highlighted in Rule 73 of the Income Tax Rules 2002. The FBR’s failure to address this issue has faced criticism for discriminating against manual filers.

The FBR’s violation of Rule 73 by deeming manually filed returns as “inactive” despite timely submission has drawn ire. Recommendations from the FTO to rectify these shortcomings and implement SOPs are deemed necessary by the President.

This case is considered for escalation to the apex authority SIFC for potential restructuring of the FBR. The President has upheld the FTO’s recommendations, emphasizing the need for SOP implementation to ensure active status for all filers in line with the Board’s ATL issuance.[/vc_column_text][/vc_column][/vc_row]