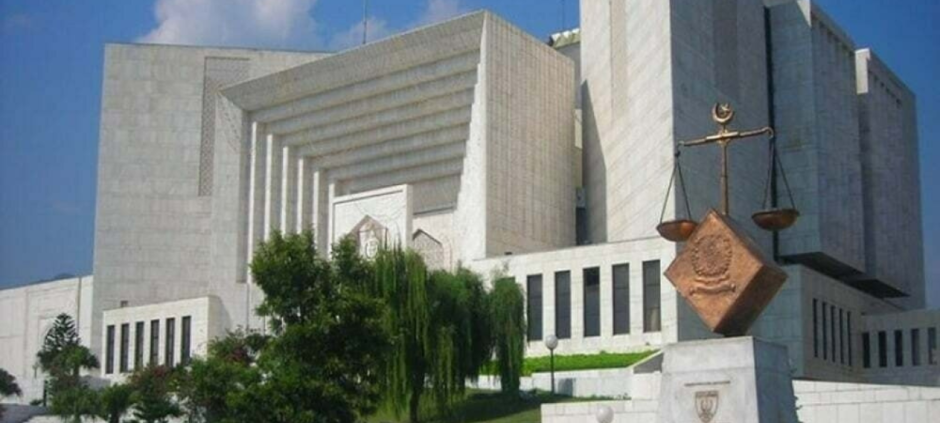

The Supreme Court of Pakistan has ruled that the Federal Board of Revenue’s (FBR) practice of issuing immediate recovery notices without allowing reasonable time for taxpayers is illegal. This significant ruling came after the court reviewed appeals filed by the FBR, which sought to validate billions of rupees in tax recovery notices against private companies.

The three-member bench, led by Justice Muneeb Akhtar, dismissed the FBR’s intra-court appeals. These appeals had argued that the recovery notices should be upheld despite being issued on the same day as the appeal decision by the Commissioner of Inland Revenue. The Supreme Court, however, upheld the decision of a single judge of the High Court, which had previously annulled the contested recovery actions.

In its judgment, the Supreme Court emphasized that tax recovery must follow due process and cannot infringe upon the constitutional rights of citizens and businesses. Justice Ayesha Malik, in her detailed opinion, stated that instructing banks to withdraw funds from accounts on the same day as an appeal decision is a breach of fair trial standards. The court also clarified that tax recovery must allow a reasonable period for compliance, rejecting FBR’s interpretation of “by the date” as meaning “on the same day.”

The court annulled Rs2.92 billion in recovery notices issued to one company and quashed a Rs1.88 billion withholding tax recovery against another company. Justice Malik criticized the FBR’s actions as a “dictatorial use of power” that damaged the reputations and operations of businesses.

This ruling comes in the wake of a previous Supreme Court decision declaring FBR’s filing of FIRs and arrests against taxpayers without legal grounds as unconstitutional. The court’s ruling emphasizes the importance of balancing revenue collection with the protection of civil rights.

Also Read: Supreme Court Reserves Judgment on Military Court Trials of Civilians