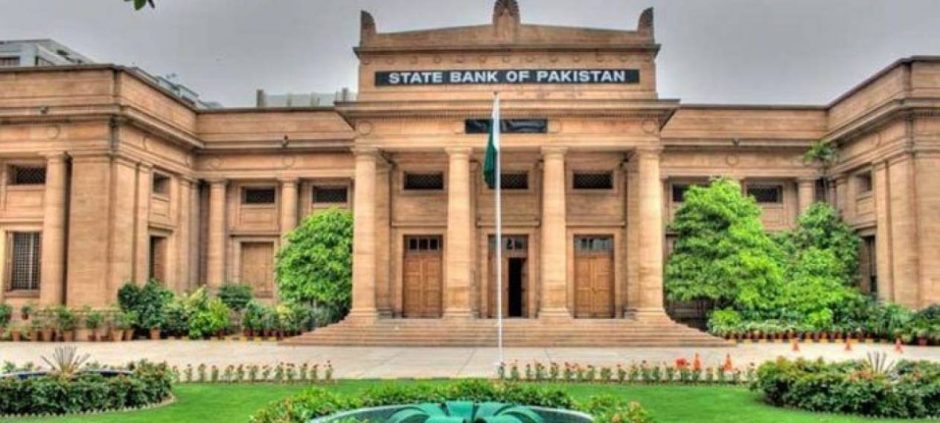

The State Bank is expected to maintain the policy rate at 11 percent in its upcoming monetary policy meeting scheduled for December 15, according to a report by Arif Habib Limited (AHL). Analysts say the central bank is prioritizing stability amid rising inflation and external pressures.

Inflation in Pakistan has risen from 4.1 percent in July 2025 to 6.1 percent in November 2025, mainly due to flood-related disruptions in food supply. The average inflation for the first five months of FY26 remains at 5 percent. However, analysts warn that price pressures could increase further during Ramadan and Eid, potentially pushing monthly inflation temporarily into double digits.

The State Bank is likely to wait for more stability before considering any rate cuts. Average inflation for the full year is expected to remain within its medium-term target range of 5 to 7 percent.

On the external front, the Pakistani rupee has appreciated by 1.2 percent this fiscal year, supported by stronger remittance inflows and progress under the IMF program. Despite this, the trade deficit widened to USD 2.9 billion in November 2025, a 32.8 percent increase year-on-year. Imports rose while exports declined, pushing the trade deficit to USD 15.5 billion over the first five months of FY26. Remittances provided partial relief, rising 9 percent to USD 3.2 billion in November.

Large-scale manufacturing in Pakistan grew 4.1 percent year-on-year in the first quarter, signaling early economic recovery. Bond market trends also indicate an unchanged policy stance, with yields remaining stable across short and long tenors.

In other related news also read State Bank Of Pakistan Declares Internship Opportunities

AHL’s survey of banks, insurers, corporates, and asset managers found that 71.6 percent expect the State Bank to keep the policy rate unchanged, while 28.4 percent anticipate a 50 basis points cut. The central bank continues to monitor inflation, trade, and economic indicators before making any adjustments to monetary policy.