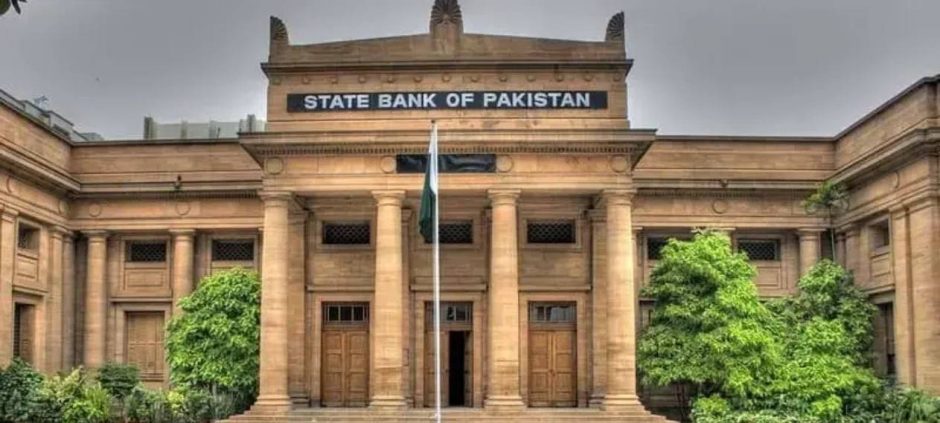

The State Bank of Pakistan has announced a reduction in its policy rate in the final monetary policy decision of the year. The central bank cut the interest rate by 50 basis points. This brought the policy rate down from 11 percent to 10.5 percent.

The State Bank made the decision after holding a monetary policy meeting. Officials reviewed major economic indicators before finalizing the move. The bank said easing inflation played a key role in the decision. This is the first rate cut after several months of policy stability.

For the past four monetary policy meetings, the State Bank had kept the interest rate unchanged at 11 percent. The latest cut signals a cautious shift in monetary policy. It also reflects growing confidence in inflation control and macroeconomic stability.

According to the central bank, inflation has shown clear signs of slowing. This improvement allowed room for a limited policy adjustment. However, officials stressed that risks still exist. These include global uncertainty and domestic fiscal pressures.

The rate cut is expected to reduce borrowing costs for businesses and industries. Cheaper loans may help support economic activity. Analysts believe this could provide some relief to the private sector. However, they also say the impact may be limited due to the modest size of the cut.

Market expectations had pointed to a larger reduction. Despite this, the State Bank chose a gradual approach. Experts say the central bank remains cautious due to its commitments under the IMF program. These conditions restrict aggressive monetary easing.

Even after the reduction, the policy rate remains high. Analysts noted that it is still about five percentage points above the current inflation rate of 5.5 percent. This gap shows the central bank’s continued focus on price stability.

The business community has long called for single-digit interest rates. Business leaders argue that lower rates are needed to boost investment and growth. However, the central bank has not met these demands so far.

Economic experts believe interest rates may stay above single digits in 2025. They point to fiscal challenges and external account pressures. These factors limit the space for sharp rate cuts.

In other related news also read

Overall, the decision reflects a careful policy shift. The State Bank aims to balance inflation control with economic support. The central bank has signaled that future decisions will depend on economic data and stability trends.