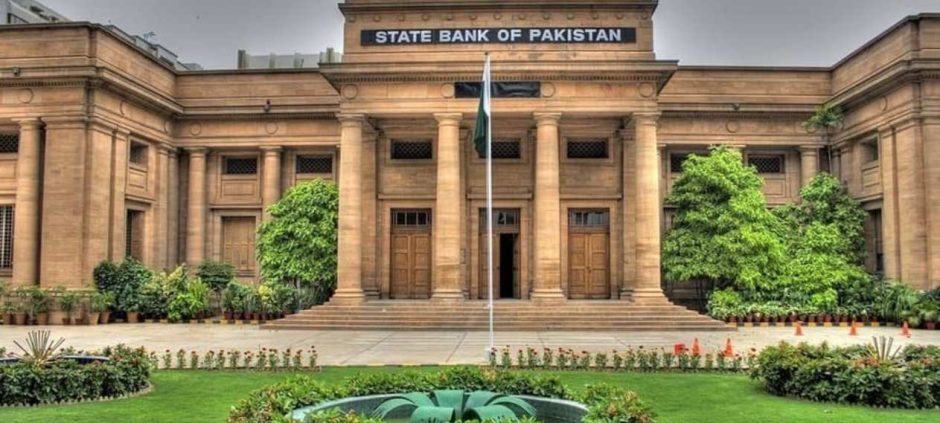

The State Bank of Pakistan (SBP) is set to launch its upgraded payment system, PRISM+, tomorrow. This new system marks a major advancement in Pakistan’s financial infrastructure.

PRISM+ is based on the international ISO 20022 messaging standard. It will offer a faster Real-Time Gross Settlement (RTGS) for large payments and introduce a new Central Securities Depository (CSD). The CSD will help banks manage government securities like T-Bills and PIBs more efficiently.

With PRISM+, the SBP aims to make financial transactions quicker and more secure. The system will allow real-time transfers, scheduled payments, and priority processing of important transactions. Banks will also have live dashboards to monitor payments and settlements.

The new platform will also improve bond trading. Banks can participate in auctions and secondary market trades with instant settlement. PRISM+ supports open market operations, enabling the SBP to control liquidity by injecting or withdrawing funds as needed.

Security and transparency are key features. Every transaction will have an audit trail, and only authorized users can perform actions. The system also includes real-time alerts for any issues during settlements.

PRISM+ introduces tools to manage liquidity better. It prioritizes critical payments and allows banks to reserve funds specifically for systems like Raast and 1Link. The Intraday Liquidity Facility will help banks avoid delays during cash shortages.

Operating hours have been extended to improve access. Banks can now also handle payment cancellations in real time.

The SBP believes PRISM+ will modernize Pakistan’s financial ecosystem and support its Vision 2028 goals. This system is designed with feedback from many stakeholders to meet local and global standards.

In other related news also read SBP Confirms Cryptocurrencies Are Not Banned