Pakistan’s current account balance returned to a deficit of $103 million in May 2025, a notable improvement from the $235 million deficit recorded in the same month last year but a reversal from the $47 million surplus seen in April 2025.

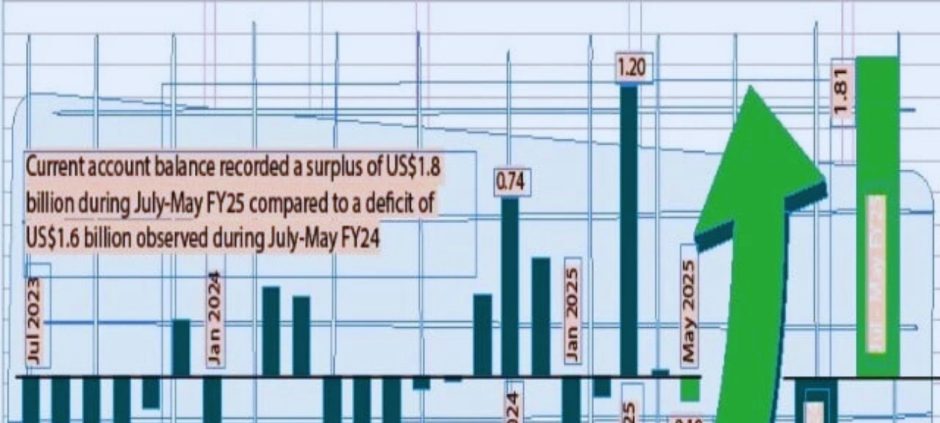

Despite this monthly setback, the country has maintained an overall current account surplus of $1.8 billion in the first eleven months of FY25—a sharp turnaround from the $1.6 billion deficit during the same period last year. However, economists warn that persistent trade imbalances and external vulnerabilities remain key concerns.

Read More : Petrol and Diesel Prices Set to Rise in Pakistan

Trade Deficit Widens, Remittances Provide Relief

The trade deficit expanded to $3.2 billion in May 2025, up from $2.2 billion a year earlier, driven by an 11% surge in goods imports ($54.1 billion) outpacing a modest 4% growth in exports ($29.7 billion). For the 11-month period, the trade deficit reached $27 billion, compared to $23 billion in the previous year.

The surplus was largely sustained by a 26% year-on-year surge in remittances, which hit $38.1 billion, offsetting the growing trade gap. Analysts project Pakistan will close FY25 with a current account surplus of $1.6 billion—its first in 14 years.

Export Challenges Persist

Exports declined by 19% year-on-year in May 2025, falling to $2.4 billion, while technology exports—previously a growth driver—slipped 1% to $329 million. Despite this monthly dip, IT exports rose 19% year-on-year in 11MFY25, reaching $3.5 billion, supported by:

- Expansion of Pakistani IT firms in global markets, particularly the GCC.

- The State Bank of Pakistan (SBP) increasing the foreign currency retention limit for exporters from 35% to 50%.

- The introduction of equity investment abroad for IT companies, boosting confidence.

Services and FDI Weakness Add Pressure

The services sector remained in deficit at $2.7 billion, while the primary income deficit—reflecting profit repatriation and debt payments—stood at $7.9 billion. Foreign direct investment (FDI) also dropped sharply to $1.98 billion, signaling investor caution amid economic and political challenges.

Outlook: Surplus Fragile Amid External Risks

Analysts caution that the surplus is cyclical, not structural, relying heavily on remittances and import controls. “A rebound in imports or slowdown in remittances could quickly reverse gains,” noted an expert. Risks such as volatile oil prices and rising debt servicing costs further cloud the external sector’s stability.

In May 2025, the primary income deficit narrowed by 47% year-on-year to $777 million due to lower profit repatriation, while secondary income (including remittances) rose 12% to $3.9 billion. However, month-on-month declines highlight ongoing volatility.

Pakistan’s external account remains under pressure, with sustained reforms needed to ensure long-term stability.