[vc_row][vc_column][vc_column_text]

[wonderplugin_audio id=”2″]

[/vc_column_text][rs_space][vc_column_text dp_text_size=”size-4″]Ahead of the final derivatives series expiration of the year, investors are undecided

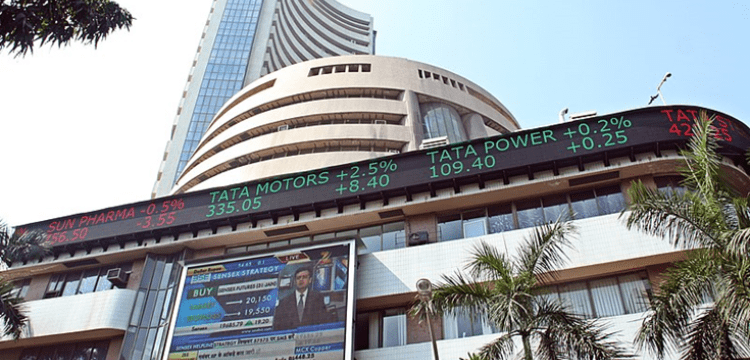

BENGALURU: Investors were concerned by the rise in COVID cases in China as Indian shares began lower on Thursday, reflecting a decline in global markets.

As of 09:18 IST, the Nifty 50 index (.NSEI) was down 0.38% at 18,051.40 and the S&P BSE Sensex (.BSESN) was down 0.41% at 60,655.13.

Information technology (.NIFTYIT), automobiles (.NIFTYAUTO), oil and gas (.NIFOILGAS), and metals (.NIFTYMET) all had declines of over 0.5% among the key sectoral indexes.

Of the Nifty 50’s constituents, 44 saw a decline, with losses above 0.75% at Hindalco (HALC.NS), JSW Steel (JSTL.NS), Maruti Suzuki (MRTI.NS), Eicher Motors (EICH.NS), and Power Grid (PGRD.NS).

Wall Street equities closed lower overnight after investors assessed the U.S. Federal Reserve’s rate hike path on mixed economic data released earlier in the week and concerns over a surge in COVID-19 cases in China.

Asian markets also declined, with the MSCI Asia ex-Japan index (.MIAPJ0000PUS) losing 1.03%.

Intraday volatility will be a factor in today’s session ahead of the expiry of the December derivatives series, the last series of 2022, as traders settle their futures and options contracts.

Capping losses for domestic equities were oil prices, which fell on China demand concerns. Brent crude <LCOc1> fell below $83 per barrel while U.S. crude hovered around $79 per barrel.

Lower oil prices aid oil-importing countries like India, where crude constitutes the bulk of the country’s import bill.

($1 = 82.7360 Indian rupees)[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][/vc_column][/vc_row]