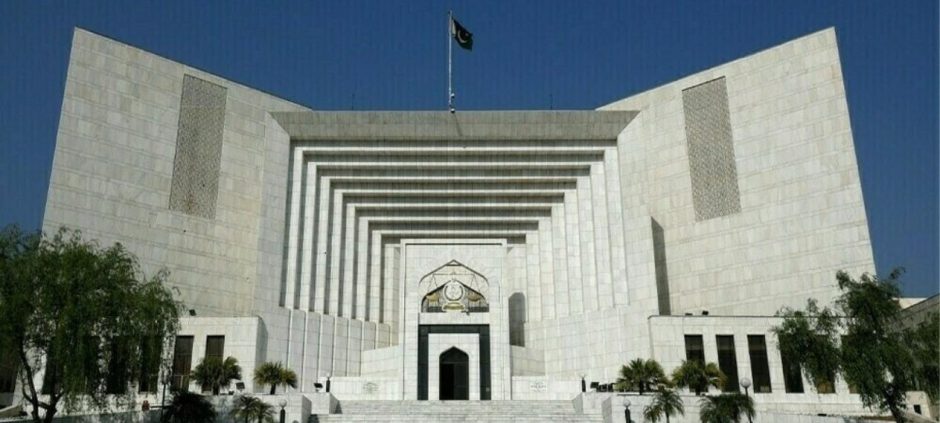

The Federal Constitutional Court has upheld the controversial Super Tax, rejecting over 2,000 petitions filed by companies challenging its legality.

The court confirmed that Sections 4B and 4C of the Income Tax Ordinance, which form the basis of the Super Tax, are lawful. These provisions were first introduced in 2015 and amended in 2022.

High Court rulings that questioned the law were partially quashed. The Federal Court stated that those decisions were incorrect to the extent they challenged the tax framework.

The court emphasized that parliament has full constitutional authority to impose taxes on income. Claims that the Super Tax was discriminatory were dismissed.

Certain exemptions remain in place. The tax will not apply to Mudaraba, mutual funds, or beneficiary funds. Concessions granted to sectors like oil and gas will continue through relevant tax authorities.

The Super Tax targets incomes exceeding Rs300 million. Due to ongoing legal challenges, more than Rs200 billion in revenue had been withheld. The federal government is now expected to collect over Rs300 billion.

Companies had argued that the tax was unlawful, but the court rejected their claims. Counsel Makhdoom Ali Khan represented multiple companies during the hearings. The detailed judgement will be issued later.

Officials say the ruling is a major boost for revenue collection amid fiscal pressure. The verdict allows smooth implementation of the Super Tax without further legal obstacles.

The decision resolves a long-standing constitutional challenge and reinforces parliament’s authority to legislate taxation. Authorities said it will strengthen fiscal stability while keeping existing sector-specific exemptions intact.

In other related news also read Federal court rejects TikTok’s request to delay US ban.

Experts believe the ruling will help the government secure much-needed funds for public expenditure and reduce delays in revenue collection.