The Asian Development Bank (ADB) has approved a major financing package for Pakistan’s Reko Diq copper-gold mine, marking the country’s largest-ever foreign direct investment. The project aims to strengthen the global supply of critical minerals, support the clean energy transition, and drive economic growth in Pakistan.

ADB President Masato Kanda said the project would not only bolster the global minerals supply chain but also create jobs and help Pakistan build a more resilient and diversified economy.

Under the plan, ADB will provide up to $300 million in senior loans to Reko Diq Mining Company (RDMC) and a $110 million partial credit guarantee for the Government of Balochistan’s equity contribution. RDMC is a joint venture, with Barrick Mining Corporation holding 50%, Balochistan government 25%, and three federal state-owned enterprises sharing the remaining 25%.

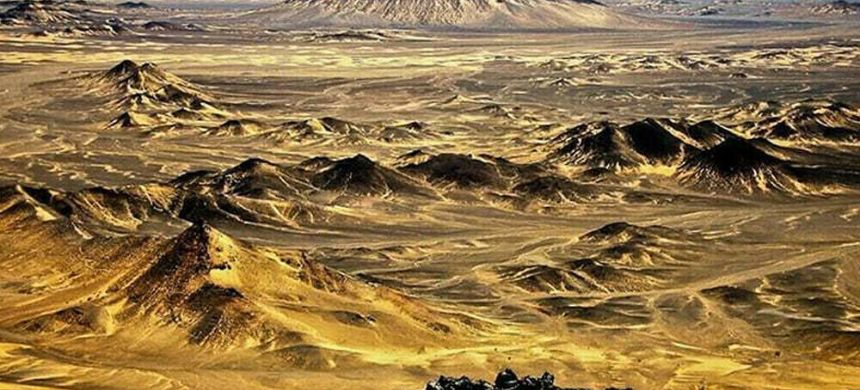

Located in Balochistan’s Chagai district, the mine is expected to become the world’s fifth-largest copper producer, averaging 800,000 tons of copper concentrate annually. It will create thousands of jobs, boost regional development, and support healthcare and education programs.

Production is scheduled to begin in late 2028, with the mine projected to operate for at least 37 years under strict environmental and social safeguards.

In recent development on this project, Pakistan Secures $700M World Bank Loan for Reko Diq