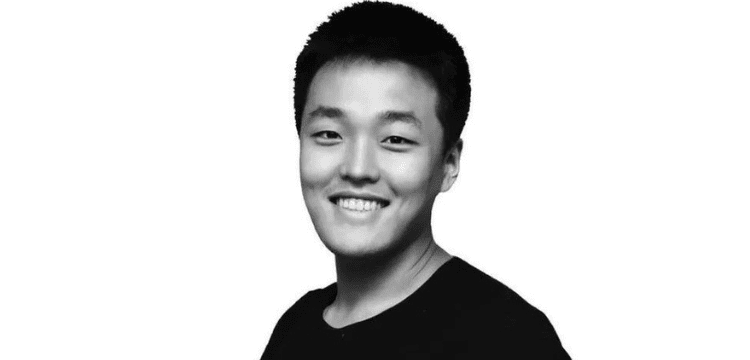

[vc_row][vc_column][vc_column_text dp_text_size=”size-4″]Do Kwon, the fugitive cryptocurrency boss responsible for the $40 billion (£32.5 billion) collapse of the terraUSD and Luna tokens, has been apprehended in Montenegro, according to South Korean police.

Prosecutors in the United States have since charged him with fraud.

Earlier this year, US regulators charged Mr. Kwon and his company Terraform Labs with “orchestrating a multibillion dollar crypto asset securities fraud.”

The company did not immediately respond to a request for comment from the BBC.

Last September, South Korean authorities issued an arrest warrant for Mr Kwon, believing Terraform Labs had violated capital market rules.

They believed he was in Serbia and sent officials to Belgrade to negotiate, despite the fact that the two countries do not have an extradition treaty.

Also Read: Brent oil drops $70 per barrel due to chaos in banking sector.

Mr Kwon has previously denied being in hiding but has never revealed where he is.

Montenegro’s interior minister, Filip Adzic, announced his arrest on Twitter, saying that “one of the world’s most wanted fugitives” had been apprehended at Podgorica’s airport.

Mr Adzic went on to say that the suspect was allegedly travelling under a false name and with forged documents. He stated that authorities were awaiting official confirmation of the man’s identity.

South Korean police confirmed Mr Kwon as the suspect in Montenegro on Friday after his fingerprints matched official records.

US prosecutors have separately charged Mr. Kwon with fraud.

According to an indictment unsealed at the US District Court in Manhattan on Thursday, he faces charges of securities fraud, wire fraud, commodities fraud, and conspiracy. Mr Kwon’s lawyer did not immediately respond to BBC requests for comment.

Montenegro has no extradition treaties with the United States or South Korea.

Mr Kwon and Singapore-based Terraform Labs “failed to provide the public with full, fair, and truthful disclosure as required for a host of crypto asset securities, most notably for Luna and TerraUSD,” according to US financial regulators in February.

They allegedly repeatedly claimed that the tokens’ value would rise and misled investors about TerraUSD’s stability.

However, the value of the token and its associated Luna cryptocurrency fell to near zero last May.

It resulted in a sell-off of major cryptocurrencies like Bitcoin, Ethereum, and Tether. As a result, the term “cryptocrash” became popular on the internet.

“I am heartbroken over the pain my invention has caused you all,” Mr Kwon said at the time.

According to blockchain analytics firm Elliptic, investors in TerraUSD and Luna lost an estimated $42 billion globally.[/vc_column_text][/vc_column][/vc_row]